Bond issuance is a vital component of Zambia’s financial system. It provides an avenue for the government to finance its budget deficit while also offering investors an opportunity to earn returns on their investments. However, there have been concerns regarding the transparency of the bond issuance process in Zambia, particularly in relation to the face value amount and bidding processes. This article explores these issues and provides recommendations for the Bank of Zambia (BOZ) to improve transparency in bond issuance.

Clarifying Face Value Amounts

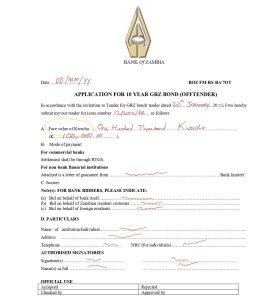

One of the key sources of confusion for investors in Zambia’s bond market is the face value amount. On the bond application form, the face value amount is indicated as the amount that the investor wishes to invest in the bond. However, this can be misleading, as it does not reflect the actual cost of the bond.

To improve transparency, BOZ can revise the wording on the bond application form to make it clear that the face value amount is not the cost of the bond but rather the amount that will be paid at maturity of the bond. BOZ could also provide a brief explanation or disclaimer on the form to clarify this point. This would help to avoid confusion among investors and ensure that they have a better understanding of the bond investment process.

Bidding Processes

Another area of concern for investors is the bidding process for competitive bidders. Currently, the bidding process takes place on the same day as the applications for the bond. This means that investors invest without knowing the actual cut-off price, which can be a source of confusion and uncertainty.

To improve transparency, BOZ could consider holding the bidding process for competitive bidders on a different day from the application for the bond. This would give investors time to assess the cut-off price and determine whether to invest. Alternatively, BOZ could provide a range of indicative cut-off prices in advance to guide investors on the expected range of prices for the bonds. This would help to provide greater transparency and reduce confusion among investors.

Improving Information Disclosure

Another way to improve transparency in bond issuance is to provide more detailed information about the bond issuance process and the factors that may affect the cut-off price. BOZ could consider publishing regular reports on the bond issuance process, including information on the bidding process, the cut-off price, and the allocation of bonds. This would help investors to make more informed investment decisions and reduce confusion around the bond bidding process.

BOZ could also consider providing information on the creditworthiness of the government and the risks associated with investing in government bonds. This would help investors to understand the risks and rewards of investing in government bonds and make informed investment decisions.

Engaging with Investors

Finally, BOZ could consider engaging with investors and stakeholders to gather feedback and identify areas for improvement in the bond issuance process. This could involve holding regular investor forums, conducting surveys, and soliciting feedback through social media platforms. This would help to ensure that BOZ is responsive to the needs and concerns of investors and is continuously working to improve transparency and accountability in the bond issuance process.

In conclusion, transparency is key in any financial market, especially in the bond market where investors are looking to invest large amounts of money for long periods of time. The Bank of Zambia has made great strides in improving transparency in their bond issuance process, but there is still room for improvement.

By implementing the above recommendations, the Bank of Zambia can further enhance transparency in the bond market and provide investors with the necessary information to make informed investment decisions. As a result, the bond market in Zambia will become more attractive to both domestic and foreign investors, leading to increased capital inflows and economic growth.

Improving transparency in the bond issuance process is crucial for fostering a healthy and sustainable bond market. The recommendations outlined in this article are practical and achievable, and I urge the Bank of Zambia to consider implementing them to further enhance transparency in the bond market.

Ultimately, improving transparency in the bond market is not only beneficial for investors but for the overall economic development of Zambia. It is the responsibility of all stakeholders, including the Bank of Zambia, to work towards creating a transparent and efficient bond market that will drive economic growth and prosperity for the people of Zambia.